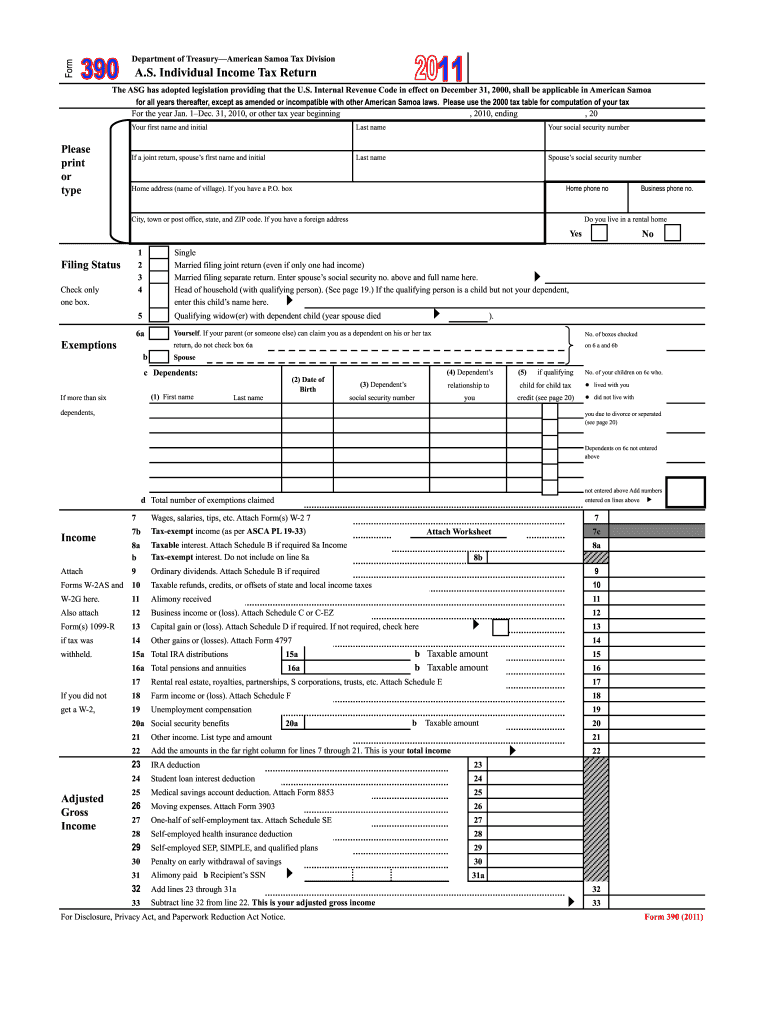

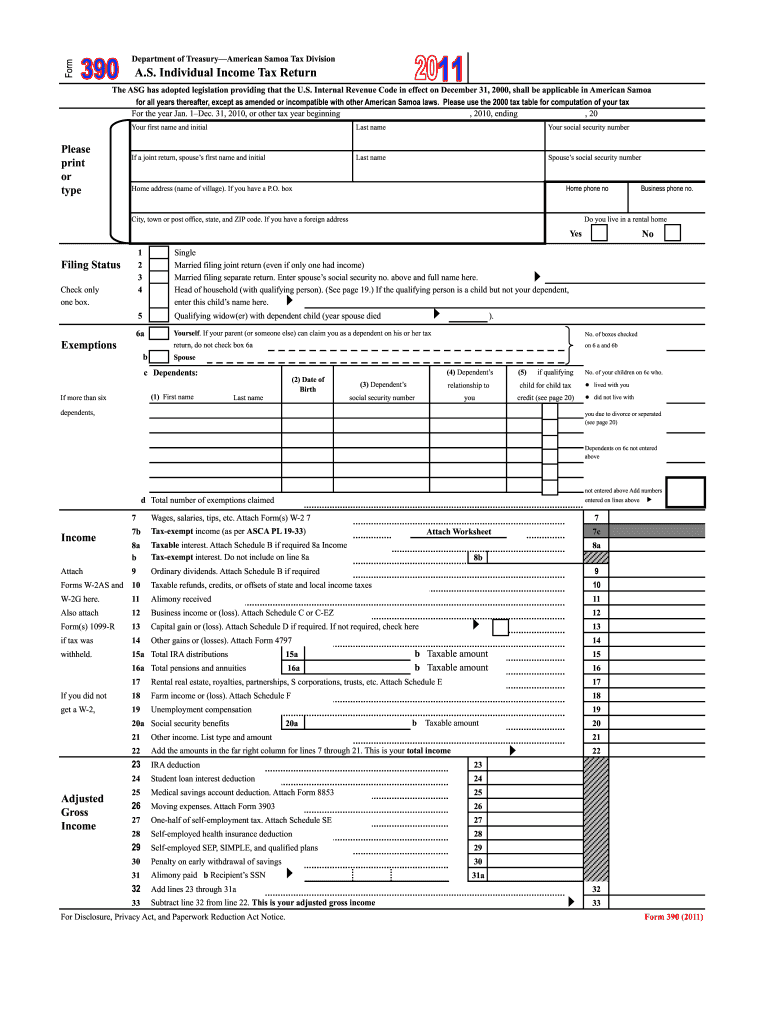

Treasury Form 390 2011-2024 free printable template

Get, Create, Make and Sign

How to edit form 390 online

How to fill out form 390

How to fill out the American Samoa tax office:

Who needs the American Samoa tax office:

Video instructions and help with filling out and completing form 390

Instructions and Help about official irs tax forms

What I want to do in this video is try to get a good understanding of how the US federal income tax rate schedule works, and also what people mean when they say tax brackets, or what does it mean to be in a tax bracket. So let's say that I make $100,000, and I'm single, and I'm not going to go into the deductions or anything fancy like that. So let's say I make $100,000 in a given year. And these numbers will change as the tax code changes, but the general idea is the same thing, although the details might change. So the way the rate schedule works is that the first $8,350 of my $100,000 will be taxed at 10×. So the first $8,350 will be taxed at 10×. So I'll be paying, what, that's pretty easy to calculate-- I'll pay $835 on that first $8,350. Now, the next $25,600, or from $8,350 to $33,950, that will be taxed at 15×. So this amounts over here, I will have to pay 15% on that. And so that the difference between $33,950 and $8,350 is $25,600 times 15×. I'll calculate it all at the end using a calculator. Now, the next $48,300 is going to be taxed at 25×. So let me draw that over here. So the next-- this next slug over here is going to be taxed at 25×. So this is the difference between $82,250 and $33,950. That's $48,300. So it's going to be $48,300 times 25×. And then finally, the remainder, the amount above $82,250, since I don't get into the next bracket above that, this part right here is going to be taxed at 28×. And let me get my trusty calculator out to figure out what that is. So, if that's going to be taxed at-- so the difference between $100,000 and $82,250. So $100,000 minus $82,250 is $17,750. So it is $17,750 times 28×. And now I could use the calculator to calculate all of these. So it's going to be-- let's do it all at once-- 17,750 times 28%-- so I'll say that its 0.28-- plus 48,300 times 25×, 0.25, plus $25,600 times 15×, 0.15. Finally, plus $835. I'm going to pay $21,720. So the sum of all of these, in total, I'm going to pay-- I already forgot the number-- $21,720. And I want to make sure you don't have the misconception-- notice, you only pay the 28% on the incremental amount when you enter that bracket. You don't pay this 28% on the entire $100,000, just on the increment above $80,250. You don't pay the 25% on the entire amount, just on the increment between $33,000 and $82,000.

Fill american samoa taxes : Try Risk Free

People Also Ask about form 390

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form 390 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.