Treasury Form 390 2011-2026 free printable template

Show details

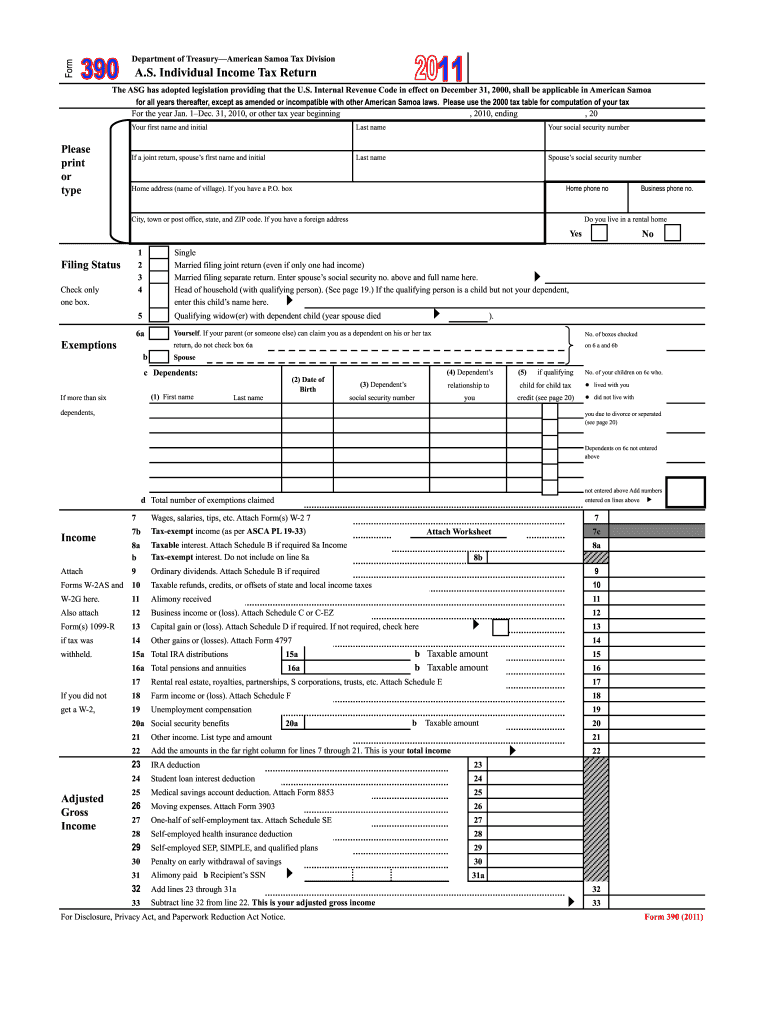

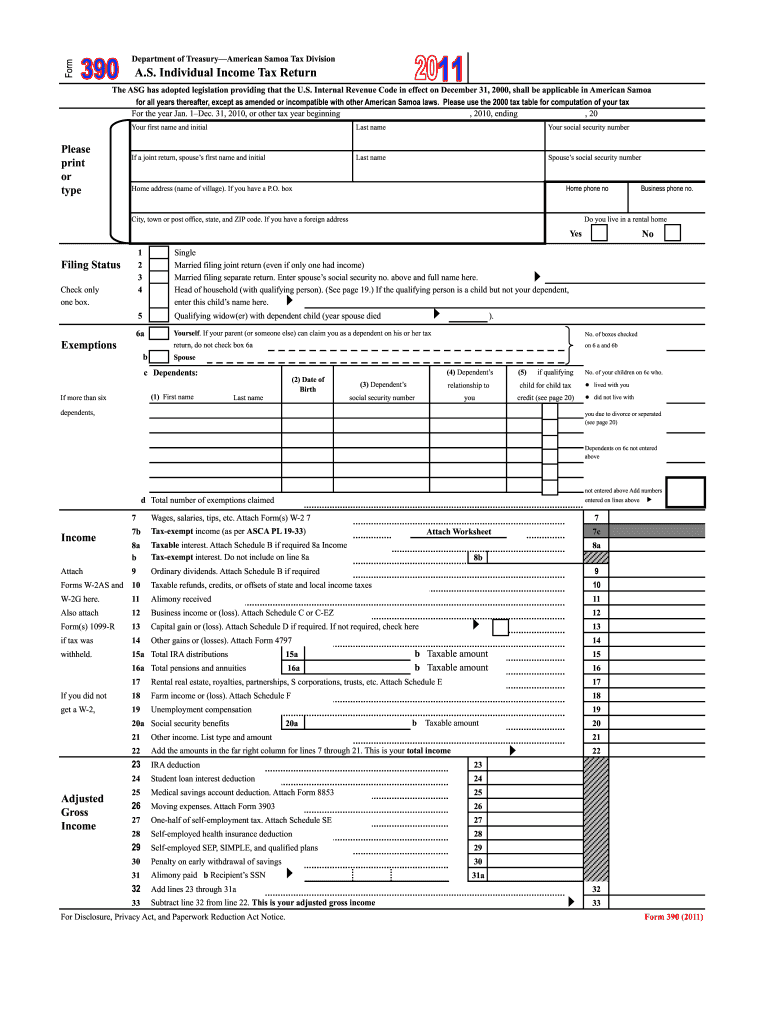

Form Department of Treasury--American Samoa Tax Division A.S. Individual Income Tax Return The ASG has adopted legislation providing that the U.S. Internal Revenue Code in effect on December 31, 2000,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 390

Edit your the purpose of treasury form 390 is to ensure compliance financial accounts and related transactions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax office american samoa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit american samoa tax form 390 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit asg tax office form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out american samoa tax office phone number form

How to fill out Treasury Form 390

01

Begin by obtaining a copy of Treasury Form 390.

02

Fill in your personal information in the designated fields, including your name, address, and social security number.

03

Complete the section that pertains to the type of transaction for which you are filing the form.

04

Provide the required details about the financial institution involved.

05

Review your entries for accuracy and completeness.

06

Sign and date the form at the bottom.

07

Submit the form to the relevant authority via mail or electronically, as instructed.

Who needs Treasury Form 390?

01

Individuals or entities that are claiming a refund for taxes withheld on interest payments.

02

Any person who has had taxes withheld from a specific type of income and is eligible for a refund.

Fill

415 itr 390

: Try Risk Free

People Also Ask about american samoa tax rate

Is Samoa tax free?

Taxation. Resident companies in Samoa are subject to a 27% corporate tax rate. However, all Samoan offshore companies are free (zero tax) from all local taxation, which includes, but is not limited to taxes on profits, capital gains, transactions, and contracts.

Do Samoans pay US income tax?

American Samoa does not use a state withholding form because there is no personal income tax in American Samoa.

Does American Samoa pay US taxes?

American Samoa has its own tax system that is independent of the tax system of the United States. It has significant differences, but it is based on the tax code of the IRS or United States.

Who is eligible for EITC in American Samoa?

Have investment income below $19,000 in tax year 2021. Have a valid Social Security number by the due date of your 2021 return. Be a US citizen or national, or American Samoa legal resident alien with a valid American Samoa immigration ID.

How much is the tax in American Samoa?

Sales Tax Rate in Samoa averaged 15.00 percent from 2020 until 2023, reaching an all time high of 15.00 percent in 2021 and a record low of 15.00 percent in 2021. This page provides - Samoa Sales Tax Rate (VAGST)- actual values, historical data, forecast, chart, statistics, economic calendar and news.

How much is income tax in Samoa?

A resident company is charged at the rate of 27% in its global taxable income while non-resident is charged at the rate of 27% on its taxable income derived from the Samoa source.Income Tax Rates. ANNUAL INCOME EARNEDTAX RATEIncome not exceeding SAT15,000NILSAT15,001 - SAT25,00020%Over SAT25, 00027%

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete american samoa sales tax online?

pdfFiller has made it easy to fill out and sign american samoa taxes. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit does american samoa pay federal taxes in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your rev code 390, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit samoa form of government on an Android device?

You can make any changes to PDF files, such as 390 revenue code, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is Treasury Form 390?

Treasury Form 390 is a form used by the U.S. Department of the Treasury for reporting certain financial transactions related to tax compliance.

Who is required to file Treasury Form 390?

Entities that are required to report specific transactions or holdings of foreign financial accounts and assets must file Treasury Form 390.

How to fill out Treasury Form 390?

To fill out Treasury Form 390, you must provide details regarding the entity, the nature of the transactions, and any required supporting documentation.

What is the purpose of Treasury Form 390?

The purpose of Treasury Form 390 is to ensure compliance with U.S. tax laws by reporting foreign financial accounts and related transactions.

What information must be reported on Treasury Form 390?

Information that must be reported on Treasury Form 390 includes the name of the account holder, account numbers, foreign bank information, and any pertinent financial details relevant to the transactions.

Fill out your Treasury Form 390 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

American Samoa Sales Tax Rate is not the form you're looking for?Search for another form here.

Keywords relevant to department of treasury american samoa

Related to revenue code 390

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.